ATM cards usually have several digits written on them (on both sides; front and rear) and if you are the type that perform a lot of online transactions, you probably will be familiar with these digits. In fact, you may know them by heart already or have them saved in your browser for faster checkout. On the other hand, if you basically use your ATM cards for point-of-sale (POS) transactions or cash withdrawals at ATM stands, you might be oblivious of the existence and importance of these numbers on your debit card.

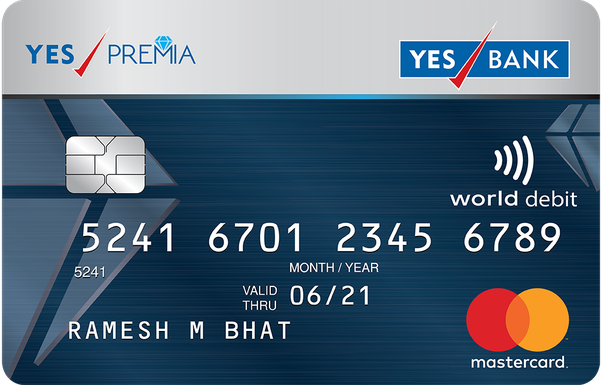

Anatomy of a Debit card

While majority of debit cards are made out of plastic, some are also made entirely of metal. One thing both cards have in common, however, are the digits on them. Depending on the card material, preference of financial institution, and some other factors, these digits could either be printed on a debit card or carved into it. Basically, the numbers you’d find on a debit card have two purposes: account identification and security. With some of these digits, your account information can easily be accessed. And with all of the digits, funds in your account can be accessed. We highlight the numbers you’d commonly find on a debit card, what they mean, their importance and where you can find them.

1. Debit card number

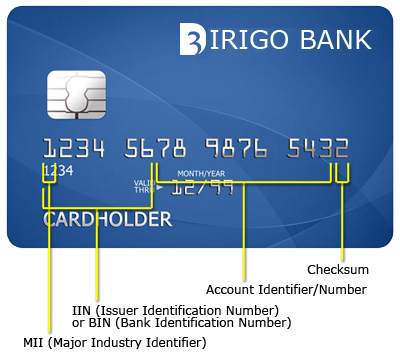

The 16-digit number (often grouped into four’s) found on the front of your debit card is known as the Card number. This number is also known as your Card Identification number and it is also stored in your card’s magnetic chip/strip so that whenever you use your card at a POS or an ATM terminal, the card number is read by the machine. While the 16-digit number on your card seem like ordinary numbers, they actually mean more than that. Each number (and group of numbers) have what they represent. Let’s dissect it.

First Six Digits

The first six digits of the 16-digit debit card number basically reveal information about the company/institution that issued the card to you. These first six digits are known as the Issuer Identification Number (IIN). When you use your debit card at POS and ATM terminals, the first six digits tell the machine who company that powers your card. Some common card issuers and the numbers that make up the IIN of their cards include:

MasterCard: the first six digits usually starts with 5 e.g 5378 67.VISA: the first six digits usually begins with 4 e.g. 4589 76.

These first number of these six (6) digits might vary though; depends firstly on the industry that issued the card.

First Digit

The first number of 16-digit debit card number is firstly determined by the category which the industry that issued the card belongs to e.g. Banking and Finance, Airline, Petroleum, etc. The first number of your debit card is called the Major Industry Identifier (MII). The first number used on debit cards issued by the following industries are listed below:

1 — ISO and other industries2 — Airlines3 — Airlines and other industries4 — Travels and entertainment (American Express or Food Club)5 — Banking and Finance (VISA)6 — Banking and Finance (Master Card)7 — Banking and Merchandising8 — Petroleum9 — Telecommunications and other industries10 — National Assignment

7th to 15th Digit

While the first six digits of your debit card number are linked to the issuer of the card, the next 9 numbers (7th to 15th) on your card is linked to your account in the institution that issued you the card. Say you were issued a card by Bank of XYZ, the 7th to 15th digits of your debit card links your account in Bank XYZ to your debit card. NOTE: This isn’t your account number. Also, these digits do not reveal any information about you or your bank account.

Last or 16th Digit

The last (16th) digit in your debit card is used to check the validity of a card. It is known as the Check Digit. Check Digit verifies card numbers for accuracy and ensures that the numbers weren’t entered incorrectly.

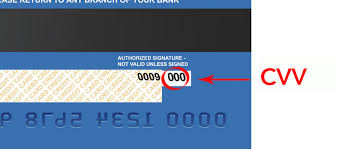

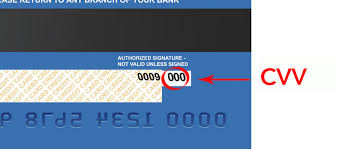

CVV

CVV is the abbreviated form for Card Verification Value. CVV is a three-digit number that is always located on the rear of your card. It is often written in bold italics and is mostly required to complete online transactions like shopping, paying bills and subscriptions, etc. Albeit not common, some institutions (like American Express) debit card CVV number is made of 4-digit. CVV is a security and fraud-prevention measure put in place to further ensure that you are truly the owner of the card you use in transacting online. Generally, CVV numbers are requested for when you aren’t using the physical debit card. To ensure that you have the card in your possession, you’ll be prompted to provide the card’s CVV number as an added layer of protection.

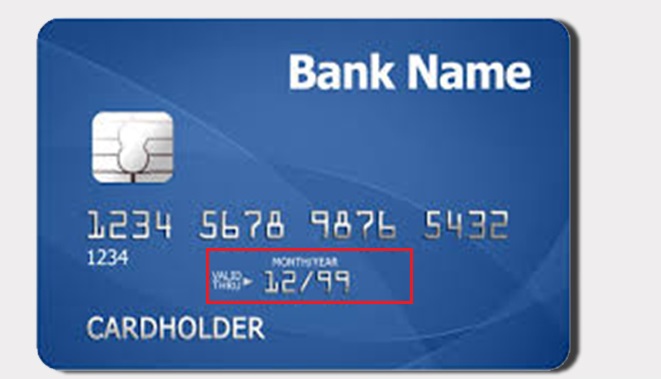

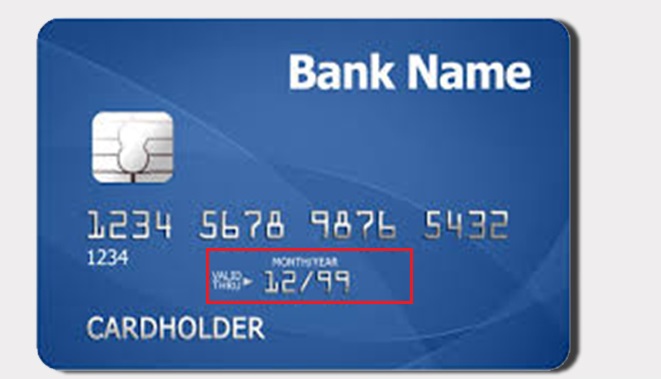

Expiration Date

Expiration or Expiry Date is another important component of a debit card. Generally, expiration date is often written on a card as two-digits (representing the month) followed by another two-digit (representing the year) separated by a hyphen (-) of a forward slash (/). Expiration date refers to the date which a card will no longer be valid to be used for transactions. Beyond this date, a debit card will cease to be valid for any type of transactions you want to use it to perform. Before a debit card expires though, the issuing institution would have alerted the holder and prepared a new card. The new card will come with new details: new 16-digits debit card number, new CVV, and of course, new expiration date. Like CVV number, expiration date is used as a security and fraud-prevention tool. Also, institution use expiration date to ensure that users have newer and better security features, newer card designs, as well as “healthy” functional cards as old cards slowly get damaged and wear out over time. Expiration date is also printed or embedded on the front of a debit card. The trio of debit card number, expiry date, and CVV are all important details of your debit card that you need to guard properly and keep away from prying eyes. In fact, no one asides you should know or come in contact with these numbers. They not only reveal details about your account but are also important security details you shouldn’t joke with.