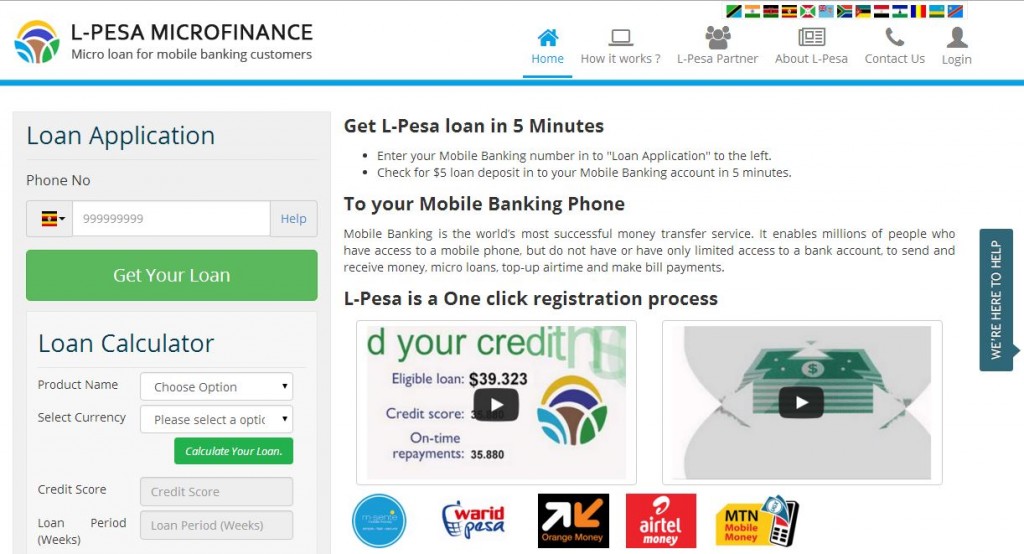

They cut out most of the intimidating form-based application process and red tape with a one click registration on their website. Most of the interaction with L-Pesa will be on their website and your mobile phone. According to their Website,

How it Works:

We were able to register for the loan almost instantly by logging onto the L-pesa website and inputting a mobile number. It seems that the service can work with most of the Ugandan telecoms like MTN, Airtel, Africell and UTL. There is no need for an actual bank account. To apply, simply enter your mobile number on L-Pesa website. You can choose to process your repayments weekly or daily, giving you more flexibility and control over your finances. The loan approval process is fast and within minutes you could have access to your loan. The steps to get a cash loan through mobile banking are simple. Once you make your application, including details of the amount required and your proposed repayment amount, and your application is approved, the money goes directly into your mobile phone account, and can easily be repaid in the same way.

Is this the Future of Banking?

With the increasing usage of mobile phones, more people in Africa are having access to mobile banking facilities. With mobile banking, one can make payments on goods, services and bills. It is also possible to access a cash loan from your mobile phone. However, mobile money loan facilities are still were a bit alien though now possible. Getting a cash loan through mobile banking would save time and shorten the process significantly. Since there is no need for fancy banking halls and paying lot’s of staff, it would bring down costs leading to favorable interest rates. For people in rural and remote areas, these loans save on time and cost of travel, and greatly aid in improving the quality of life. As a matter of fact, mobile banking is faster than conventional banking. Transfers from one mobile phone to another are instant, allowing the exchange of goods and services to progress rapidly. It is also incredibly convenient, as a person saves time and cost on travel and waiting at banks. A mobile banking service is excellent for the financially marginalized, who may not have access to formal banking services. No matter where one is located, whether in an urban or rural, mobile money allows one to carry out transactions including funds transfers and bill payments. Photo Credit: xJason.Rogersx via Compfight cc